Small banks and credit unions face a challenge as they grow–how to scale financial statement analysis as the bank’s portfolio expands. While growth clearly shows you’re doing something right, you risk errors and poor customer service without a system designed to grow with you.

Is Excel falling short?

If you are among the many community banks and credit unions that have leaned on Excel for their financial statement analysis for years, you may be thinking it’s time for a more modern, efficient system. Financial statement analysis software like FISCAL spreading is more accessible than ever, but you may find discerning the features of different systems overwhelming.

In this post, we’ll dive into the features you should be looking for in a financial statement analysis software to help guide your decision.

Financial Statement Analysis Software Must Haves

What you need in a financial statement analysis software solution will depend upon your resources, the technology you currently have, and the size of your organization. In general, you will want to look for customizable templates, a means for identifying adjustments and a system that’s built to effectively track cash flow.

Here are our top four must-haves as you assess financial statement analysis software.

1. Robust template selection

A common complaint we hear from companies using Excel is how long it takes to create spreadsheets for spreading and analysis. Many community banks and credit unions have only one or two Excel spreadsheets for their various financial analysis tasks. They aim to save time, but are not designed in a way that considers how these different types of businesses provide their financials. The result is a template that requires a high degree of customization when setting up, inserting new rows, cutting and pasting rows, etc.

Take, for instance, a template spreadsheet built for a small retail business. The information required for this account will be vastly different from a real estate holding company or non-profit borrower.

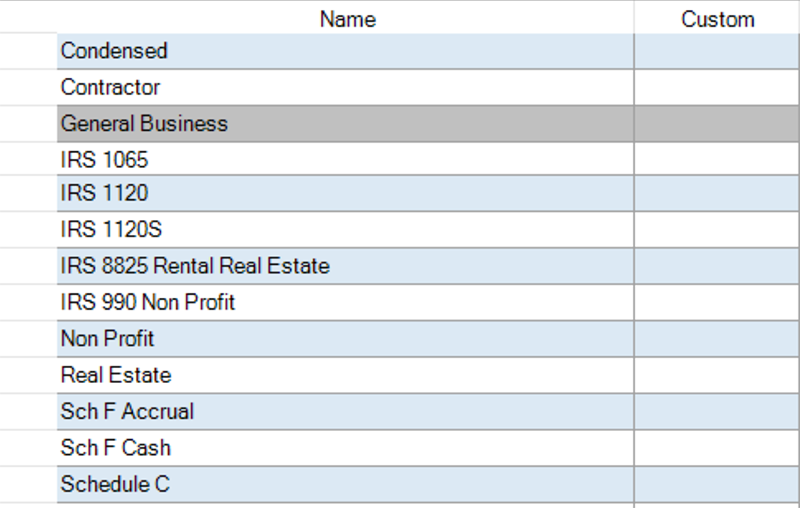

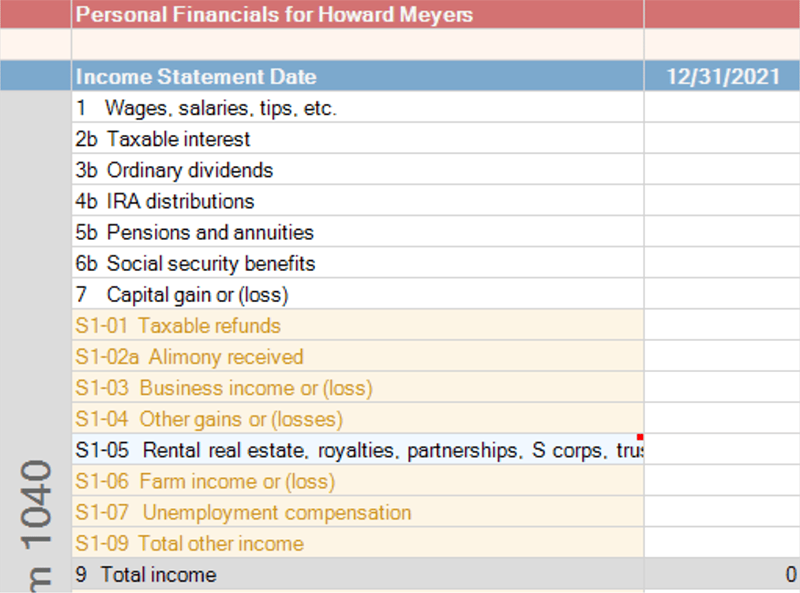

When deciding on financial statement analysis software, look for a solution that offers a wide range of templates, including templates for:

- Type of business

- Tax return

- Personal financials

Having a selection of templates built for various business scenarios will save banks hundreds of hours each year setting up financial analysis spreadsheets.

You don’t need to purchase a full end-to-end Loan Origination Systems (LOS) to obtain these ready-made templates, either.

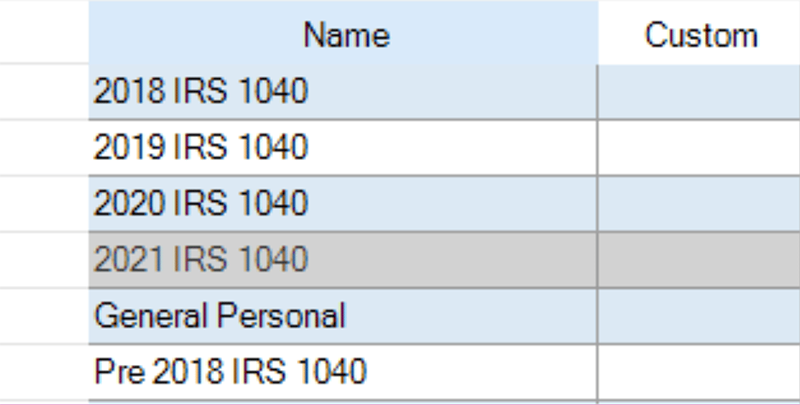

FISCAL offers out-of-the-box templates for various types of businesses designed to help make small banks and credit unions more efficient and save time. FISCAL’s templates can also be modified to create your own Custom Templates.

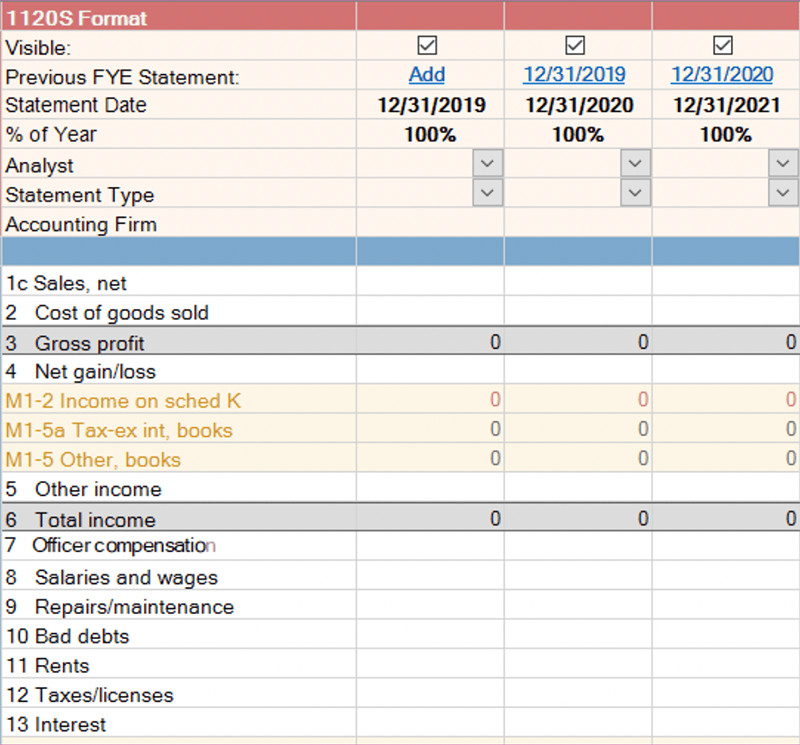

2. A dedicated panel for adjustments

Another concern we hear often is finding a better way to make adjustments. After getting all the financial information into an Excel spreadsheet, banks often need to make changes. This is especially common when looking at Debt Service Coverage.

This was a common issue when accounting for income from the Paycheck Protection Program (PPP) loan forgiveness from 2020, but can arise any time there is a material one-time expense or income item. This relief package from the federal government is something that should be accounted for, but only for one year. To note this adjustment to cash flow in an Excel spreadsheet, banks will often edit a formula, making it invisible to the reviewer. The result is having to go back and change the item later, when a better solution would be to create a panel where adjustments are recorded.

Financial statement analysis software should have a mechanism for documenting adjustments, specifically to cash available for debt service. Including a dedicated panel for adjustments provides reviewers a full financial picture without having to worry about formula errors or remember to go back and make changes.

3. Financial statement analysis software should be purpose built

Financial statement analysis software should do what it’s meant to do–effectively and efficiently spread financial statements and analyze cash flow across all business entities.

Achieving this in Excel takes a high degree of skill that banks often don’t have the expertise or time to build. Software, like FISCAL, is built for the real-world scenarios community banks and credit unions often encounter. It can automatically track global cash flow across various businesses for the same owner so that you can quickly assess their ability to repay their loans.

4. Automation for rote tasks

Manual data entry and Credit Memo creation can be labor intensive processes, taking hours, days, or sometimes even weeks to gather all the information needed and get it in the right format. Excel spreads and Word memos are an imperfect system that–unless set up efficiently and with plenty of forethought and reviewed regularly–do not offer much in terms of saving time in this process.

Instead, small banks can look for a system that offers automatic tax return scanning, whether from native PDFs or paper scans, pulls the scanned numbers into a spread template, and allows the user to subsequently modify the scanned-in values.

Word-based Credit Memos require hours of duplicate data entry or tedious copy/pasting of everything from spread and ratio information to the existing loan and deposit relationship of the borrower and related entities. Statement spreading software can feed this information directly into a Memo for you, and FISCAL offers highly customizable Word templates that automatically populate all of the information you’ve entered into FISCAL.

If you are upgrading to a new financial statement analysis system, it should be one that saves the bank’s officers and analysts time, reduces frustration, and results in a return on investment more quickly.

Financial statement analysis software saves you time

We often hear from banks that it’s difficult to transition away from Excel because it’s the way things have always been done. FISCAL spreading and tracking is designed as an easy to use solution that saves time and reduces frustration, helping banks get buy-in from employees throughout the lending process.

Out of the box, FISCAL spreading simplifies data entry and streamlines the underwriting process while FISCAL tracking improves standardization and consistency for financial statement tracking.

Want to learn more about the benefits of financial statement analysis software? Contact us today for a no-nonsense demo of FISCAL today.